For the second consecutive quarter, investors have significantly put less money into Dutch ventures. In this year’s third quarter, Dutch ventures have raised almost €556 million. That is around a third of the capital raised in Q3 2021, and less than half the capital raised during this year’s second quarter.

This is the outcome of EBITWISE’s Dutch Venture Capital Quarterly, a quarterly analysis of all published investment rounds via press releases, LinkedIn announcements, Crunchbase and Dealroom. Our open-sourced results are available for anyone interested in the funds for ventures that are headquartered and operating in The Netherlands. The results are visualized in the infographics below.

No Series B and later stage deals

A strong decrease in later-stage rounds is an important cause of the decline of raised investments in Q3 2022. During Q2 2022, three ventures managed to raise more than €100 million. During the past quarter, those €100+ million investment rounds were non-existent. The same conclusion can be made regarding the category of €50M to €100M rounds. In Q2 2022 there still were three scaleups that raised more than €50M, while only LightYear managed to do so in this year’s third quarter.

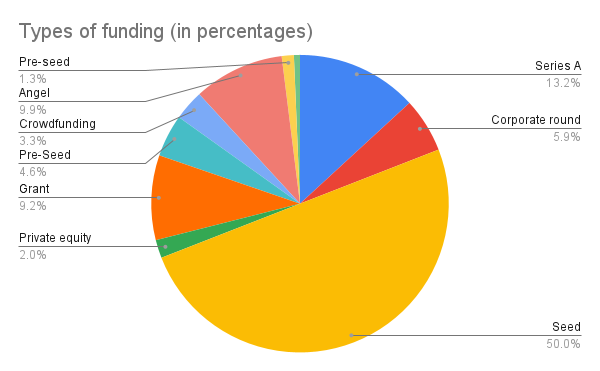

As a result, half of the 149 investment rounds that we have noted for the past quarter, exist of deals in the seed stage. Series A deals (13,2%), angel investments (9,9%) and grants (9,2%) are currently the other remaining lifelines of Dutch startups and scaleups.

Enterprise software

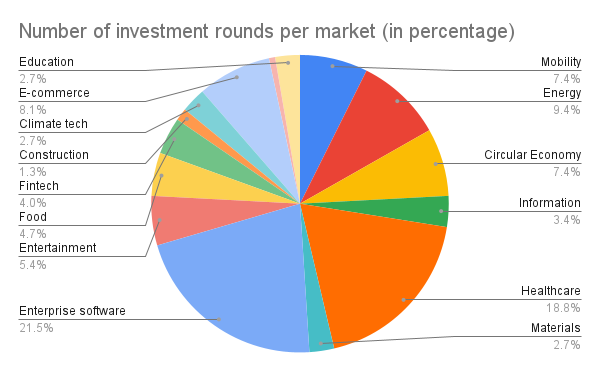

The enterprise software market leads the chart of realized investment rounds, having been involved in 21,5% of all funding rounds during Q3. Healthcare players follow in second place, taking a chunk of 18,8% from the pie chart at the right. At a distance, they are followed by energy solution providers, e-commerce ventures, mobility players and circular economy startups.

Energy solution providers

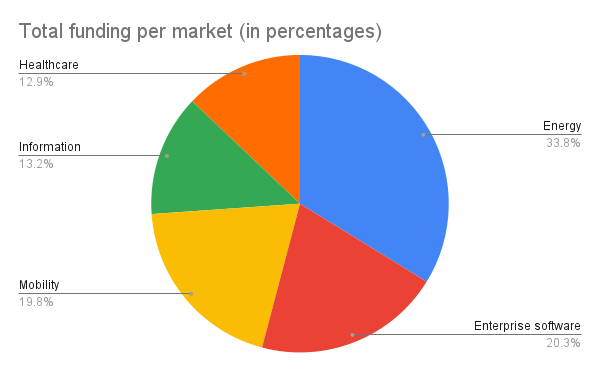

As some sectors require higher investments to get operations off the ground, we see that energy solution providers together actually raised more capital than enterprise software vendors. Also mobility players and information technology developers are top chart performers with regards to the amount of funding raised.

Amsterdam

Amsterdam was and is clearly the startup capital of The Netherlands. Looking specifically to this year’s third quarter, almost four out of ten funded ventures are situated in the largest Dutch city. Rotterdam and Utrecht, representing both 6% of the total number of funded ventures in Q3, follow in the shadows of Amsterdam.

Do you have any questions or additions to this report? Drop a line to Sebastiaan van Essen via sebastiaan@ebitwise.nl or to EBITWISE CEO & Founder Dany van den Berg via dany@ebitwise.nl.